Checkout made effortless

PayPro's internet payment gateway provides effortless checkout and easy integration. Our all-in-one monetization platform maximizes your revenue and simplifies your sales.

Easy integration, seamless checkout experience

Customer refunds taking time?

Payment gateway built for Pakistan

Multiple payment options

Fast settlements

Go global

Payment Gateway enterprise features

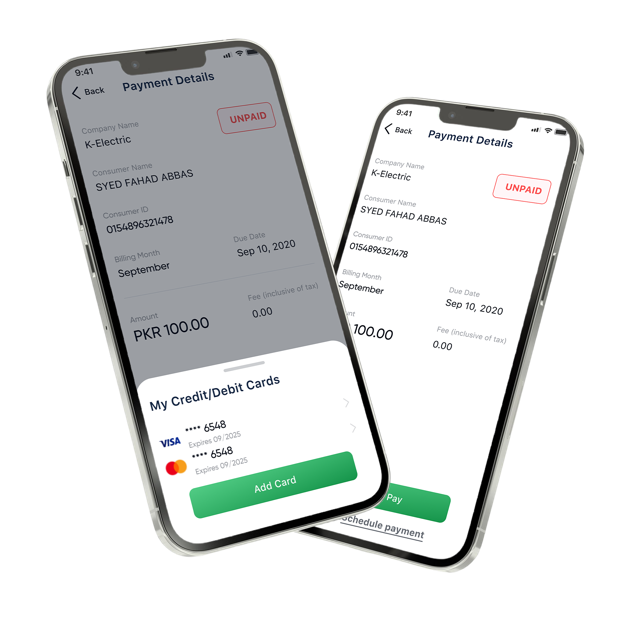

Saved payment options

Recurring payments

Pre-authorization

High success rate

Payment Gateway Integration

Sell from anywhere

You can easily receive payments in your business bank account from customers anywhere.Connect Shopify

Our payment gateway can be integrated with standardized plugins which also work with third party e-store platforms.

Connect WooCommerce

Integrate our payment gateway plugin to your WordPress E-Commerce tool and customize your checkout experience according to your needs.

Connect Magento

Integrate our payment gateway plugin to your Magento e-store website and customize your checkout experience according to your needs.

Connect OpenCart

Integrate our payment gateway plugin to your OpenCart e-store website and customize your checkout experience according to your needs.

Payment platform integration FAQs

With PayPro internet payment gateway you get the widest range of payment options. We support card based (credit / debit), digital banking (internet / mobile), digital wallets and Over-the-counter payments.

We have partnered with 22+ banks/wallets/OTC agents and are in process of partnering with other local banks as well. The list of our partner banks are as follows:

- Habib Bank Limited (HBL)

- United Bank Limited (UBL)

- Meezan Bank

- Muslim Commercial Bank (MCB)

- Allied Bank Limited

- National Bank of Pakistan (NBP)

- Askari Bank

- Bank Al-Habib (BAHL)

- Faysal Bank (FBL)

- Habib Metro

- Samba Bank

- Dubai Islamic Bank (DIB)

- JS Bank

- MIB

- Bank Islami (BIPL)

- Bank of Punjab (BOP)

- Bank of Khyber (BOK)

- Silkbank

- Summit Bank

- First Women Bank (FWBL)

- U Microfinance Bank

Wallets:

- EasyPaisa

- Keenu

OTCs:

- TCS

- Meezan Bank

- SilkBank

- AlBaraka

International Payment Networks:

- Mastercard

- Visa

Charges vary from business to business based on volumes and other parameters. They are also different for local or international payments. For a detailed breakdown of payment gateway charges, visit our pricing section or contact our support team at 0309-0729776.

No, you would require a business/merchant bank account in order to sign up with PayPro as a registered merchant. You may sign up for a sole proprietor and work with us. We recommend an account with Bank Al Falah. Click to sign up.

PayPro is the easiest and flexible payment platform for any developer to integrate with their e-store. We have simple payment APIs with easy to understand steps for all major platforms and e-commerce engines. With responsive developer support, integrating with PayPro marketplace platform is a smooth and quick experience.

Yes, you can use PayPro’s APIs to integrate PayPro marketplace platform directly with your Android & iOS app.

As a payments facilitator/marketplace platform, PayPro strives to cater to all businesses, however there are some services and goods, for which we are legally prohibited to provide our payment gateway platform.

- Firearms

- Alcohol

- Explosives

- Pornography materials or any related or similar good or service of any kind whatsoever

- Live animals

- Banned and/or illegal drugs or other controlled substances

- Fireworks or pyrotechnic devices or supplies

- Hazardous materials, combustibles or corrosives

- Bulk email software or mailing lists

- Gambling transactions

- Multi-level marketing collection fees

- Matrix websites or websites using a matrix scheme approach

- Promotion or information in relation to working from or at home

- Website promotion or search engine registration fees

- Wire transfer products and services

- Any other goods, products or services which do not comply with any applicable law or regulation whether federal or provincial laws of the Islamic Republic of Pakistan

The list of documents required for integration is as follows

- Business details

- Business Account details ( Bank Name, Branch Code, Branch Name, Branch Address, Account Title, Account Number)

- Business Account Maintenance Certificate

- NTN Number

You will need to request the e-store/online business for a refund where you made your transaction. PayPro will only process your refund on the merchant’s approval. If you require help for further assistance you can call our support at 0309-0729776.

Standard processing time for refunds can range from 21 to 28 working days.